In the face COVID-19, political drama at home and abroad, and social unrest, it’s certainly been a summer for trying our poise, hasn’t it? For individuals who have ever been a parent or a child — that is, for everyone — there are numerous comparisons we can draw between good parenting and good wealth management. While potentially spending unprecedented amounts of time with your own children as we social distance, we thought the comparison is even more timely. Plenty of patience and perspective are important qualities to embrace — as parents managing your children and as individuals managing your wealth in uncertain markets.

Patience is Your Greatest Strength

As an investor, you probably have plenty of “those days” when you wonder whether your money is ever going to grow up. It doesn’t do as you hoped. It misbehaves. It runs with the wrong crowd. It ignores your best efforts to protect it from harm.

But then there are those other days. Suddenly, your money hits a growth spurt, exceeding all expectations! It’s then that you realize many of the greatest challenges you and your investments faced along the way are the same ones that are contributing to its strength and shaping its character over time.

In the Markets, “Unusual” Is Business as Usual

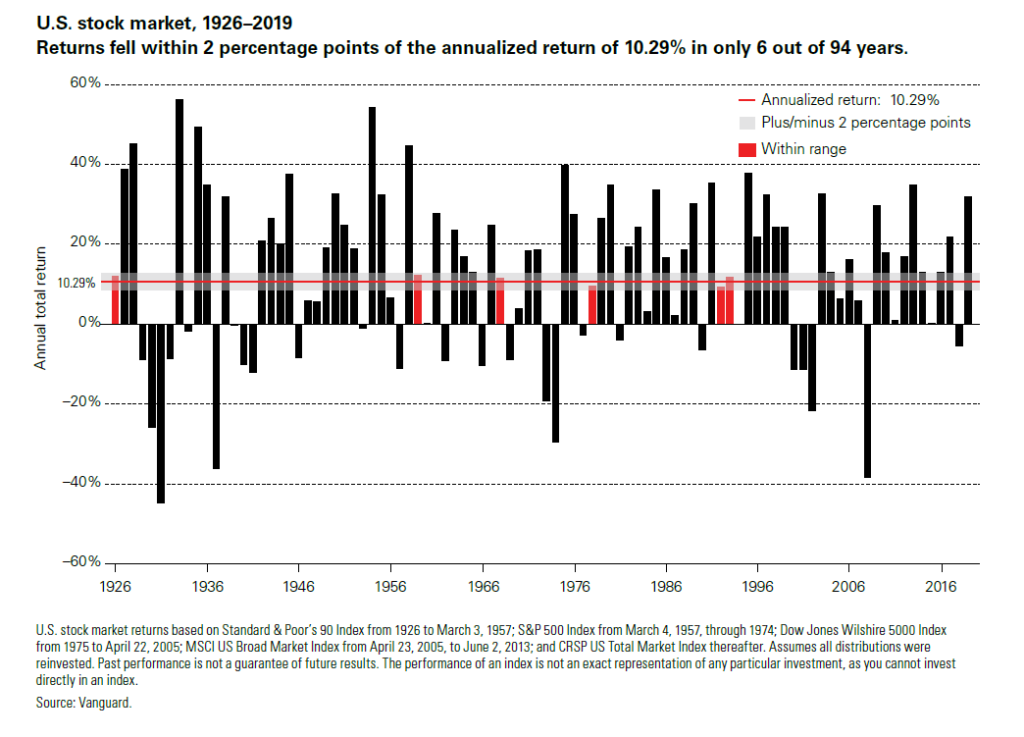

As much as we would prefer our wealth to mature in a calm, orderly way, there is solid evidence to demonstrate that returns are far more likely to occur in these sorts of anxiety-generating fits and starts. There is a certainty to the uncertainty. If expectations are potential resentments in waiting, it’s critical we set expectations appropriately.

For example, the U.S. stock market from 1926-2019 has averaged +10.29%. However, actual annual returns fell within 2 percentage points of the annualized return of 10.29% in only 6 out of 94 years! Financial markets, particularly stocks, are inherently volatile over the short term. To benefit from long-term market performance, investors should properly calibrate their expectations and stay the course.

Let’s explore another example from recent history that likely feel like ages ago. You may recall that January 2016 was an unsettling time in the market, with particularly petulant returns. Some pundits blamed China and oil and what-not. Especially in retrospect, there was no incredibly obvious reason; it was just in one of those moods.

On the flip side, in the wake of the June 23, 2016, Brexit referendum, when we might have expected the market to remain in a funk for a while, it took a dive but then mostly continued upward, especially in the U.S., where stock market indexes experienced a number of record highs in July. We’ve experienced a similar, potentially unexpected positive bounce in the global stock markets these days in the midst of COVID-19 and social distancing requirements.

Vanguard published an overview of how common it is for markets to lurch into correction territory or lower, despite their overall upwardly mobile track record. Vanguard observed, “Since 1928, the Standard & Poor’s 500 Index has spent 40% of the roughly 88-year span in some sort of setback — a correction or bear market. Over that same period, however, the index has produced an average annualized return of about 10%.”

Vanguard concluded: “A review of corrections and bear markets suggests that patience and discipline are the best responses to market turmoil.” Our point exactly.

No Favorite Child

That’s not to say that you should plan for 10% annual returns in your financial future. We certainly don’t assume investment returns that high when building financial plans. Most investors are wise to offset the heated risks involved in pursuing higher expected returns with an appropriate helping of “cooler” holdings.

We also suggest employing global diversification to manage the market risks that you do take on. Spreading your risks among multiple kinds of holdings around the world can be compared to raising several children, without choosing a favorite. Each is expected to contribute in its own special way.

The Importance of Being There

What parents don’t have days when they wish they could bypass some of the drama and skip straight to the good stuff? And yet we know that child-rearing requires us to be there for our offspring 24×7, thick and thin, on good days and bad.

We also know that, even though we give it our all, there are no guarantees. The most you can do is the best that you can — day in, day out — with the most accurate information you can find. If patience is your greatest virtue, consistency and persistence are your power tools to maximize it.

So it should be with investing, where you should avoid the temptation to jump in and out of uncertain markets. We know they are going to often misbehave and sometimes disappoint. We even know that they may never deliver as hoped for. But once you have done everything you can to position your portfolio for the outcome you have in mind, you’ve also done everything you can to stack the odds of success in your favor. The rest is where that patience comes in.

The Power of Patience during Uncertain Markets

Consider this article by Chicago Tribune financial columnist Jill Schlesinger, “Time in the market — not market timing — is the secret to investment success.” In it, Schlesinger shares stock market research dating back to 1927, finding that “for those who invest for a single day, the chance of losing money is 46 percent, but for those who invest with a 10-year investment horizon the chance of success improves dramatically — to 87 percent.”

The Wall Street Journal personal financial columnist Jason Zweig offers a visual of the same phenomenon in his article, “Volatility: In the Eye of the Beholder.” There, he considers a year’s worth of S&P 500 returns:

“Viewed daily over the 12 months that ended March 31 [2016], the S&P 500’s moves look superficially like the EKG of someone having a heart attack. Viewed quarterly, they resemble a shruggie emoticon without the smirk. And seen over the full sweep of the last 12 months, the market’s moves look like a whole lot of nothing happening in slow motion.”

Zweig describes how time has a way of smoothing out the best and worst days, and tilting the odds in our favor. As a bonus, a patient investment strategy also tends to minimize trading activities, and the costs involved, which can further contribute to your end returns.

By thinking of your wealth from this perspective, it might help you take a deep breath and carry on as this year’s politics unfold — or whenever you face difficult decisions on how to best care for your precious holdings. By sticking with a disciplined plan, day in and day out, you stand the best odds for raising wealth that you’ll be proud to call your own in the end.